First quarter earnings have kicked off defying analysts’ warnings for the dreariest season in years, according to Bank of America Corp. strategists.

Of the 30 S&P 500 companies comprising 10% of the index that reported results so far, 90% have trounced earnings per share estimates while 73% beat on sales, strategists led by Savita Subramanian said in a research note Monday. That marks the best upside surprise in the first week of a reporting period going back to at least 2012, thanks largely to impressive results from JPMorgan Chase & Co., Citigroup Inc., and Wells Fargo & Co.

“Big banks’ solid results despite March’s bank scare helped performance,” Subramanian wrote. “Banks may be tightening credit standards, but larger ones are operating with excess capital versus prior crises.”

Strong results from financial heavyweights have helped mitigate fears of an industry crisis after the collapse of Silicon Valley Bank last month. After better than feared results, BofA said its current 2023 EPS forecast of $200, which is below the consensus $220, may be too low if further evidence shows March events were temporary.

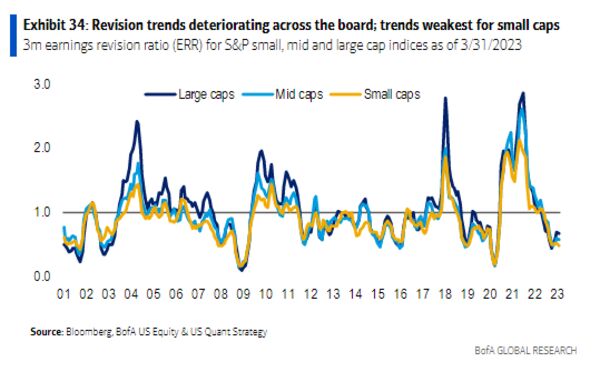

Still, BofA forecasts downward guidance from companies, noting that earnings revisions have been deteriorating across the board. Last week, strategists at the bank warned estimate cuts could accelerate in later quarters.

“A massive, systemic financial confidence shock appears to have been averted, but tighter credit is manifesting in the real economy,” the firm wrote, citing the more prevalent impact of a credit crunch on industrials and consumption.

Results expand past financial firms this week, with 26% of earnings due to be released from S&P 500 companies in all sectors except utilities. Demand outlook, margins and the impact of credit on cash use are factors that BofA are eyeing. The bank, itself, is scheduled to report first quarter earnings on Tuesday.

Morgan Stanley’s top equity strategist Mike Wilson also said Monday earnings forecasts remain overly optimistic despite recent downward revisions. The Wall Street bear warned declines in estimates will accelerate “materially” in coming quarters on disappointing revenue growth.

Meanwhile, BlackRock strategists including Jean Boivin and Wei Li said even with results expected to slump the most in three years, that will not reflect the “coming damage” yet.

JJ CR Admin

JJ CR Admin

1309 Coffeen Av. Sheridan Wyoming, 82801, United States.

Mon - Sat: 09.00 to 06.00 (Sun:Closed)